Johnny Lee

[The Episcopal News] Johnny Lee says the best part of serving as a teller, a loan officer, accounting manager, vice president of Cal-Com Credit Union throughout his career, and now, as chief executive officer of the Episcopal Community Federal Credit Union, is helping people.

“Our credit union remains committed to the fundamental principle of ‘people helping people.’ Those who deposit their funds with us enable the credit union to provide assistance to others facing difficulties securing a loan elsewhere,” Lee said. “A significant portion of our membership is comprised of individuals from underserved communities who may have been denied personal or car loans or faced exorbitant interest rates elsewhere.”

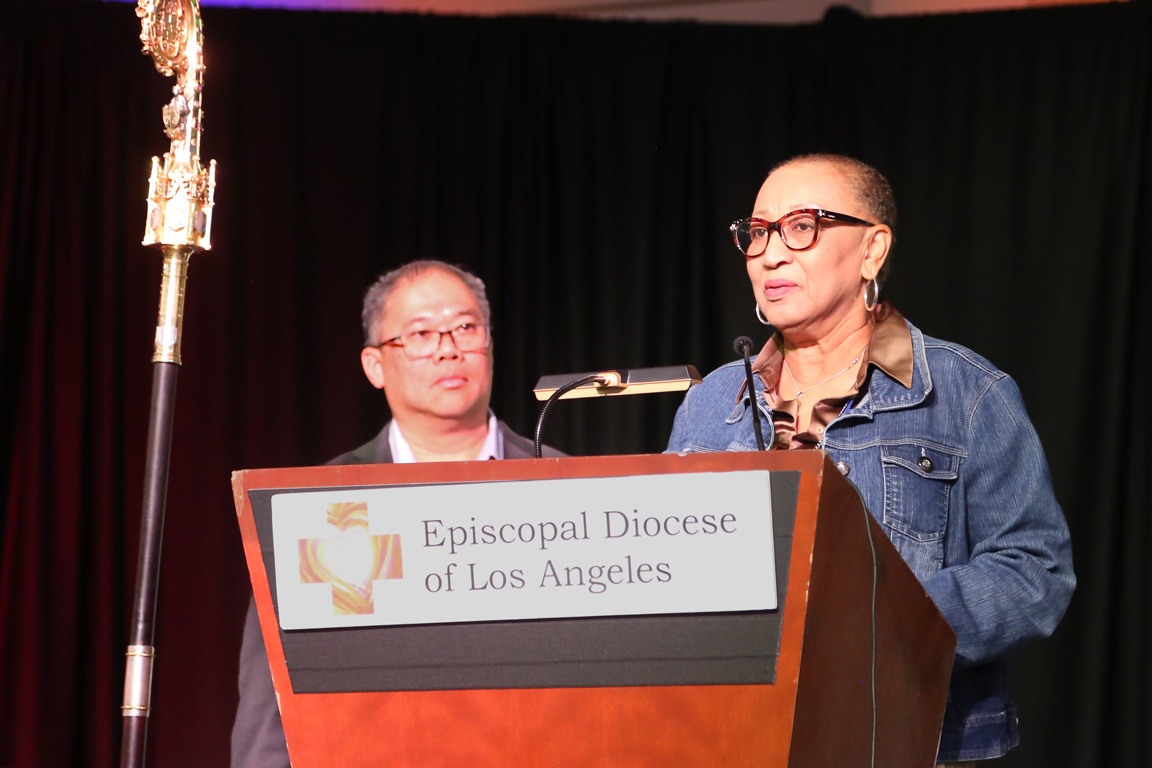

Earlier this year, Lee joined ECFCU as part of a shared employee agreement with Cal-Com, a consortium of credit unions based in Southern California. He was introduced Nov. 11 to delegates attending the 128th annual meeting of the Episcopal Diocese of Los Angeles in Riverside, by his predecessor, Canon Urla Gomes, who retired after nearly 29 years of service.

Although he once considered a career in automated manufacturing, Lee changed his mind when he realized the potential for credit unions to positively affect not just individuals but also communities, he told The Episcopal News recently.

ECFCU’s 29-year mission as an economic justice ministry to Episcopalians and the wider community appealed to him.

“This particular credit union, and the whole board, really has the heart to help people, especially the underserved,” said Lee, 52. As part of the shared employee arrangement, he serves 40% of his time at ECFCU and typically is at the St. Paul’s Commons headquarters two days a week.

“The credit union provides traditional banking services such as savings and checking,” he said. “In an effort to enhance the banking experience, we have upgraded our technologies this year. We now offer support for Apple Pay and Zelle, and we’re excited to announce the upcoming addition of mobile deposit functionality. Furthermore, our website is currently being redesigned to serve our members better.”

ECFCU’s commitment to community outreach is evident, he added.

“Our credit union extends its support by establishing accounts for refugees and new immigrants who may not yet have established credit.” Lee said. “During tax season, we also offer free tax services staffed by credit union employees and other volunteer tax preparers. In terms of financial services, we provide personal loans, auto loans, and have recently introduced an auto-buying service. Furthermore, we partner with other institutions to offer mortgage services.”

At Diocesan Convention in November, Canon Urla Gomes outlines the history of the Episcopal Community Federal Credit Union, which she served for many years as CEO – and introduces Johnny Lee, her successor.

Support is also available to congregations. “We actively support local businesses by providing small business loans. Moreover, we extend financial assistance to churches for repairs, facility remodels, or significant purchases such as solar panels.”

Although the credit union is based in Echo Park, it offers high-tech services to all Episcopalians and members, available through the website.

Despite inflation, ECFCU continues to offer a 5% interest rate for new car purchases, for example, while market rates can range as high as 8%. Similarly, while credit card companies charge annual interest rates ranging from 20% to as high as 30%, ECFCU offers loan consolidation rates at about 10%, he said.

Founded in 1994 after the Los Angeles civil unrest following the Rodney King trials, the credit union has invested in local entrepreneurs, offering loans to defray the cost of licensing, merchandise, and mandatory cart rentals for sidewalk vendors, thus assisting the creation of L.A.’s first MacArthur Park Sidewalk Vending District in 1999.

Dan Valdez, board chair, said he is grateful to have found Lee, “who is incredibly gifted. He’s been in the credit union industry for more than 20 years and has worked with credit unions of all sizes, especially a couple which are very similar to ECFCU. We’re a rather small institution, but he’s accustomed to consulting with credit unions our size.

“He has hit the ground running. Everybody loves him. It turns out he has the same passion that I saw in Urla. And he has very diverse experience and he has a lot of experience in terms of mobile banking and remote services, which is what the credit union has been moving into.”

In addition to mobile banking and Zelle, the credit union will roll out “a totally revamped website,” Valdez said. “Johnny’s just kind of stepped in and has taken the reins and it’s been virtually seamless. He’s very well connected throughout the credit union industry. Through him, we have access to so much more than we used to. We’re thrilled, and next year we’re celebrating our 30th anniversary, so Johnny is the leader to take us into our next 30 years.”

Jennifer Miramontes, ECFCU board vice chair, called Lee “an accomplished and compassionate industry professional (who) brings vast business development experience to his latest role as CEO of the ECFCU.

She added: “I’m super grateful for Johnny. His attentiveness and follow-through have made for a seamless transition. This is a complicated position that requires patience, diligence, sharp intellect, compassion, integrity, and innovation. Johnny truly embodies all of these qualities.”

Lee praised the dedicated and hard-working ECFCU staff, which supports about 1,200 members, a number he hopes to increase. “Here you get to meet members, and they try to help every single member for whatever they need.”

A graduate of Pepperdine University, Lee holds bachelor’s degrees in both automated manufacturing and business management and attends Our Lady of Guadalupe Catholic Church in Hermosa Beach. He is married with four children.

“Two are in college. One recently graduated and another is in 5th grade,” he said. “I find joy in watching my children participate in sports like soccer and basketball. Whenever our schedules align, I cherish the moments when we can all come together for a delightful family dinner or enjoy spending time with the kids.”

ECFCU needs more deposits and members, he said. “In order to give loan money out, we need to have more money deposits.”

Lee is confident that ECFCU can grow. “I started with Cal-Com when it was smaller than this credit union, in 1997. They had about $3 million in assets and right now, they’re about $90 million.”

To learn more about ECFCU, visit its website.