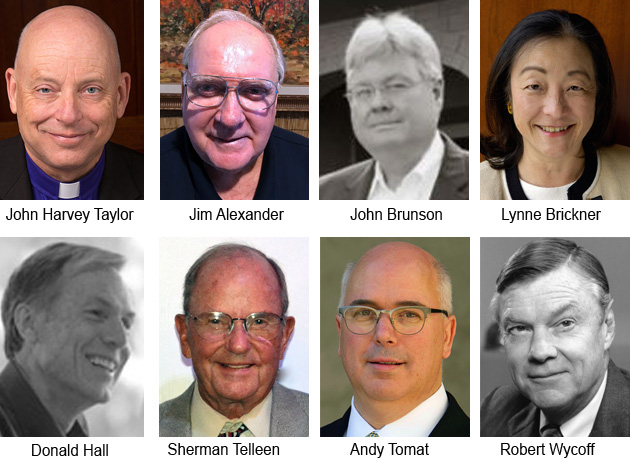

The trustees of the Diocesan Investment Trust include four members elected by Diocesan Convention for staggered four-year terms, three elected by their fellow trustees, and the bishop diocesan, who serves as the board president.

John Brunson says the overarching concerns of the Diocesan Investment Trust are both spiritual and financial, and always framed by the mission of the diocese and the question: “Are we doing the right thing — for the diocese, but also for humankind?”

Brunson, 60, a financial services professional, was elected to the DIT at the 2018 convention of the Diocese of Los Angeles, and is half-way through a four-year term. The DIT is an investment trust fund, established in 1949 to protect and help grow investments from churches, schools and institutions of the Episcopal Dioceses of Los Angeles and San Diego.

The funds invested are typically gifts, donations, bequests and additional income received by congregations and other diocesan entities that might not be needed for their annual operating budget. The DIT, working with financial services professionals at Wilshire Consulting, oversees how those funds are invested.

Typically, the DIT realizes an average rate of return, according to Sherman Tellen, 90, a retired investment counselor and a long-time trustee. “But the intent isn’t to make a lot of money,” Telleen told the Episcopal News recently. “The intent is to conserve what we have and participate in the market with as much risk as we can.”

DIT trustees have financial backgrounds and are both elected by convention and appointed by other trustees. They meet quarterly with the bishops, members of the diocesan staff and Wilshire, a Los Angeles-based firm specializing in investment products, consulting services, and technology solutions. There are approximately 150 investors in the DIT, which offers opportunities for both long-term investments, such an endowment funds, and short-term investments, such as building fundraising programs.

Funds may be invested or withdrawn monthly. The DIT will also oversee investment of the new Means of Grace Endowment Fund for the Corporation of the Diocese, according to diocesan treasurer Canon Andy Tomat.

“Per the investment policy statement established by the DIT Trustees, the DIT Long Term Investment fund is conservatively managed to return inflation +3% over the long term,” Tomat said. “Since 2012 the fund has returned 7.1% annualized, net of all fees and expenses, thus exceeding the inflation +3% goal by 2.6%. During this chaotic year the fund has returned 4.6% year to date. The total assets under management by the DIT are approximately $50M.”

The DIT provides churches, schools and institutions with a means to invest their funds conservatively and with multiple levels of investment oversight. The volunteer trustees take their fiscal stewardship responsibilities seriously, Tomat said, and have sought to improve the level of communication with co-investors in the fund. The funds are invested in a mixture of actively managed and index funds from noted sub-managers in five different asset classes: US stocks, non-US stocks, blue chip and diversified bonds, and real assets. Reports on each fund’s performance are provided to co-investors monthly.

Mission churches invest their funds in the DIT and many parishes do as well. Only churches that are able to maintain their own investment committees should be investing on their own, Tomat said.

“Growth is always an important thing when overseeing capital,” Brunson said. “But, to have the overlay of the spirit of the community, to make sure that the investment counselors are looking through the prism of our mission as a church, is unique and rewarding, and helpful in daily life.”

Trustee Lynne Brickner, a parishioner at St. Matthew’s Church in Pacific Palisades, said the DIT provides valuable expertise to local congregations, who are often focused on daily operations and their annual operating funds.

“We have a common mission,” she said. “There is a sense of shared responsibility for what we have here, to make our lives better here and translating that to making God’s kingdom more real here.

“We know that what we are doing makes possible mission program and projects and outreach that really benefit the bigger community. We take very seriously being good stewards, being good fiduciaries, making sure we get good returns and not taking crazy risks. We’re very respectful; everyone brings a different experience to our meetings. It’s been a great experience.”

The quarterly meetings typically begin with a prayer and include investment updates from Wilshire and wide-ranging conversations. Trustees also receive quarterly financial reports that update them on fund performance, she said.

Trustee Jim Alexander, 79, a mortgage banker who attends St. Andrew’s Church in Ojai, recalled receiving a nudge from Canon Steven Nishibayashi, diocesan secretary of convention, to stand for election to the DIT.

The experience has been both enlightening and inspiring. “My faith has grown immensely over these last few years. I think I have something to give,” Alexander said. “I ask questions, there are good discussion points. I feel deeply humbled by the position and will do my best to live up to what Bishop Taylor needs.”

Brunson agreed. “Bishop Taylor understands the real world but leads with Christ in his heart and is able to articulate it in a manner that I am able to go out into the real world as a Christian.

“We are mindful of what we are investing in and for what purposes,” he said. “Our prism is to look at the long-term needs of the diocese and parishes and individual entities. We are also mindful of what are the needs of the church today. Our first emphasis is to make sure, in the current investment environment, where we put our capital, and does it compromise our mission or not?”

Sometimes, Brunson added, “I am the only guy pushing back on something. That’s what makes the Episcopal Church so great. There are a lot of different opinions in The Episcopal Church.”

Frequently DIT’s discussions are focused on: “the mission of the diocese and church, what role do we play in the past, the present and the future in the Episcopal USA movement. We are always looking to the future,” he said. “What will we do to build capital, will it be preserved even though it’s not a fortune, but a significant amount?”

In other words, “Four generations from now, what will be the result of our actions? What will we do for people we will never meet?”